stamp duty malaysia calculation

Instruments that are required to be stamped under the Stamp Duties Act must be stamped within 40 days of first execution. So for calculating the stamp duty the first thing is to identify in which category the document or instrument falls under.

Everything You Need To Know About Seller S Stamp Duty Ssd Ohmyhome

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

. The system is thus based on the taxpayers ability to pay. In proportion to the value of the consideration depending on the class of instrument. An example of Car Insurance Premium Calculation for Both Comprehensive and Third Party Fire Theft Coverage West.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. RM100000 x 1 RM1000.

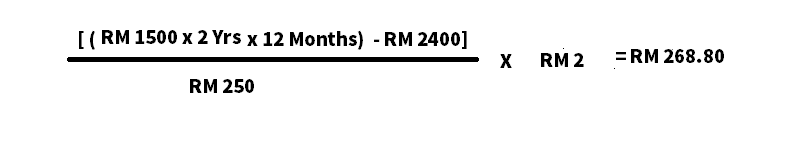

When goods are dutiable on an ordinary basis ad valorem specific or compound duty rates may be assessed. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Commercial house or equipment lease.

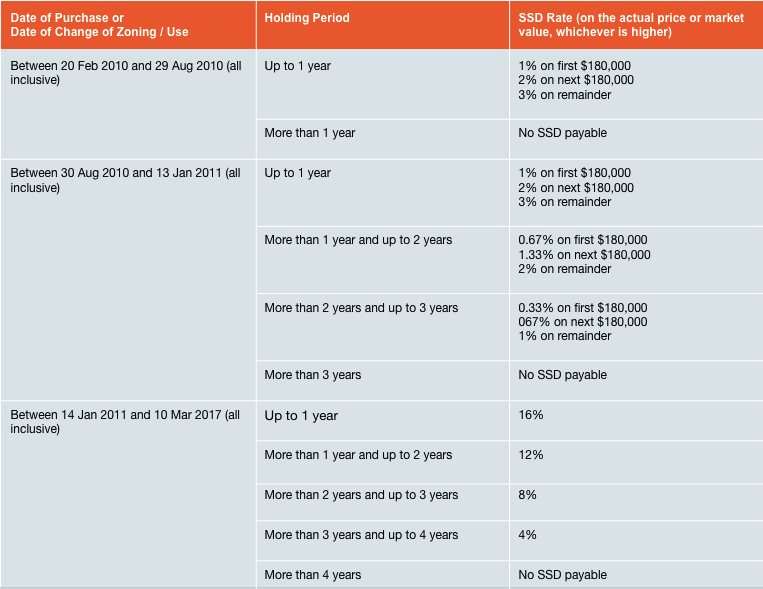

Total Stamp duty is RM5000. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties. SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty.

Increase of the capital in cash. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250. 4 of income spent on loan. Transfer of real estate.

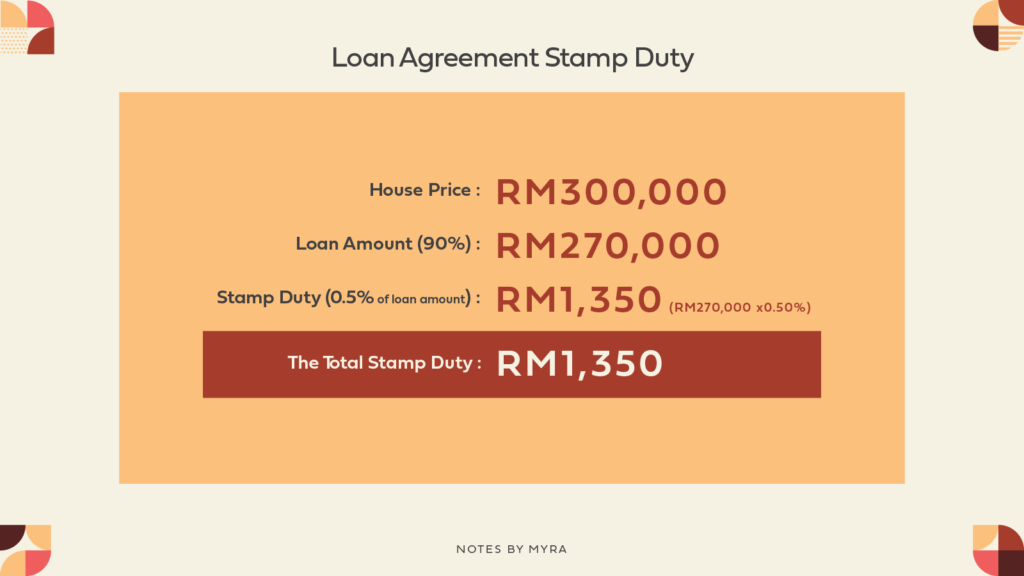

Must contain at least 4 different symbols. Stamp Duty Malaysia On A Loan Agreement Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase. This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The Country of Origin of imported goods also plays a part in determining the applicability of a number of other trade policies such as TRQ preferential tariffs anti-dumping duty anti-subsidy duty etc. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house.

To get the best deal among the listed contractors customers are advised to liaise and request for quotations prior to appointing one. 500- whichever is lower. The stamp duty is free if the annual rental is below RM2400.

1 on the guarantee value. Use our Stamp Duty Calculator to find out how much SDLT Stamp Duty Land Tax may be payable on your residential property purchase in England or Northern Ireland. A specific rate is a specified amount per unit of.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity.

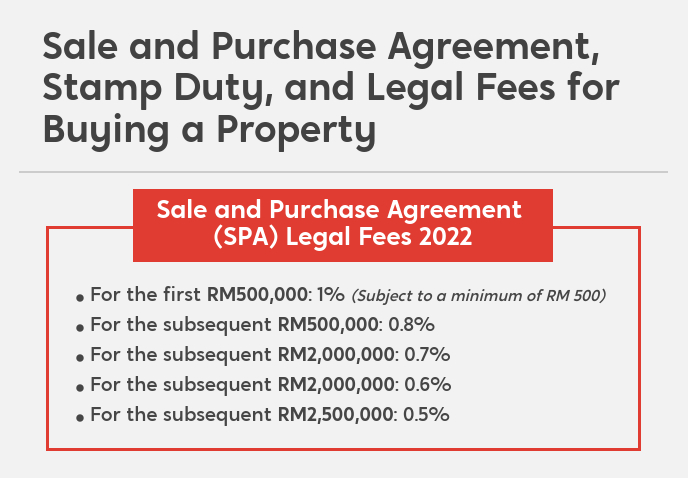

Stamp duty is chargeable either at fixed rates or ad valorem ie. Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Get 247 customer support help when you place a homework help service order with us.

1 of the increase where the share capital is greater than XOF 100. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Both quotations will have slightly different in terms of calculation.

From RM100001 to RM200000 2 RM200000 x 2 RM4000. For the purpose of stamp duty calculation there are 3 categories of transaction. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government.

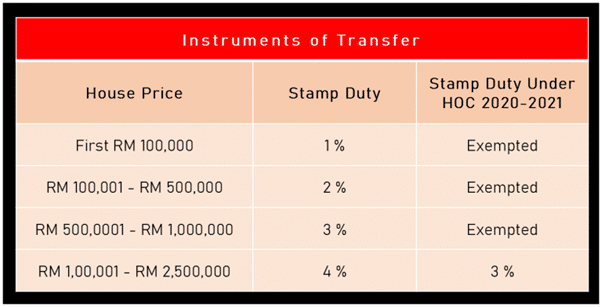

Scroll down to see a sample calculation. Stamp duty calculation Malaysia 2020 Stamp Duty Exemption Malaysia 2022 The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows. 2 applicable on the basis of the annual rent.

Learn how to calculate stamp duty from a trusted source with PropertyGuru. Memorandum of Transfer MOT Sale and Purchase Agreement SPA. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Stamp andor registration duty. Stamp duty is 1 of the total rent plus deposit paid annually or Rs. In the first category the charges on the stamp duty remain fixed regardless of what value is mentioned in the document or instrument.

1 on the debt value. Follow Loanstreet on Facebook Instagram for the latest updates. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-.

Effective from 1st April 2017 commercial. An ad valorem rate which is the type of duty mechanism most often applied identifies the percentage of tax that will be assessed on the value of the merchandise such as 7 ad valorem. For First RM100000 RM100000 Stamp duty Fee 2.

Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us. Currently under this category customers are required to pay upfront all these essential charges which include the Connection Charges Stamp Duty and Security Deposit to apply for electricity.

Stamp duty is imposed at the rate of 075 on the authorised share. Updated with the latest rates for September 2022 onwards. Stamp duty Fee 1.

5 on the sales price. ASCII characters only characters found on a standard US keyboard. From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001.

Import and export goods are reduced with or exempted from customs duties import VAT and consumption tax according to state regulations. For East Malaysia the basic premium for a new car of each category Comprehensive rate for first RM1000 sum insured from the table above RM2030 for each RM1000 or part thereof on value exceeding the first RM1000. The stamp duty is free if.

Stamp duty in Singapore is a type of tax that all homeowners must be familiar with. The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Calculate now and get free quotation.

Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Loan Calculation Assumptions.

Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate. 6 to 30 characters long. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016.

For the first RM100000 1.

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Stamp Duty In Malaysia Everything You Need To Know

How Much Does The Stamp Duty For Your New Home Cost

Home Loan Calculator Malaysia Stamp Duty Legal Fee Valuation Fee 2022 Property Malaysia

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

A Comprehensive Property Tool In Malaysia Propsocial

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Buying Property And Stamp Duty Planning Action Real Estate Valuers

How To Calculate Stamp Duty Of Shares Bossboleh Com

Home Ownership Campaign Hoc 2021 Properly

Import Duty Malaysia Online Wholesale 57 Off Krcuganda Org

Calculation Of Stamp Duty On Instruments Of Transfer Of Shares

Comments

Post a Comment